BUILDING A BUSINESS TOGETHER – PART 2

Income statement

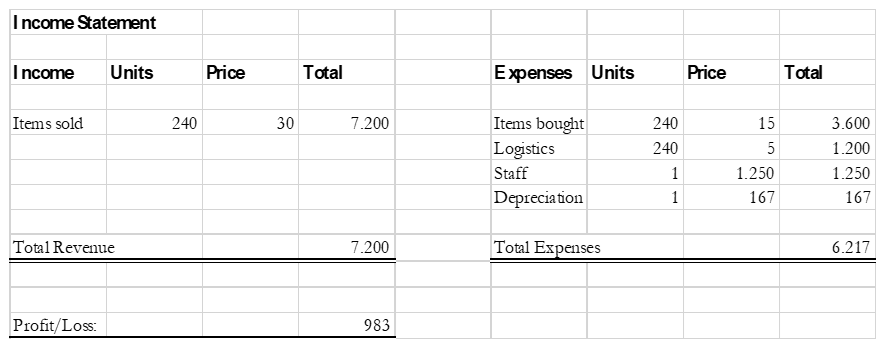

Next, we will have a look at what we call an income statement. This is where we can see how our business is actually doing during a business year. What we will find there is first the revenue that we made (goods sold) as well as our expenses and our net profits. For our business let's assume that we have a sales price of 30 per item sold and that we are able to turn over our stock once a month. That would be 20 items sold per month (or 1 per business day) and generates 600 in revenue per month to a total of 7,200 for the whole year.

On the side of the cost we have to purchase our goods. As we have a great supplier we are able to purchase them at 15 each. Our costs for purchasing the items then sum up to 3,600. But that's not all of the costs. We also have to pay for packaging and shipment, that's where we calculate another 5 per unit to a total of 1,200 for our logistics in order to get everything shipped to the customer.

Employees

Since we don't want to work and rather pursue other great ideas, we will have to hire someone to deal with customer inquiries, watching the stock and ordering new inventory when the current one gets sold off. For that we hire someone and we calculate that we will need them for 30 minutes a day on average and we pay 10 per hour. On 250 business days that will sum up to a total of 1.250 in labor costs.

As a business owner

we need to be aware that some of the things we use for conducting our business will lose value and get worn out and have to be renewed within a certain timeframe.

Remember we bought a Tablet to do all of the work for our business? Well we expect that after three years we will have to replace the tablet and get a new one. Therefore it would be wise to plan ahead for it and put the cost for a new tablet in our Income Statement, so that we have set aside the needed money for it. We call this depreciation.

As our tablet costs were 500, we simply divide that through 3 years and put in 167 as depreciation costs into our Expenses column. This sums up to total expenses of 6.217 as you can see in the spreadsheet below.

Earnings

When we deduct the expenses from our revenue, the money we made selling our goods, we have a net profit of 983. Not bad for the first year and a business where we don't even have to work ourselves in. The goal of all businesses is eventually to earn money and to distribute this to the company owners (this is us). We call that a dividend and we will explain more about in in a later chapter.

Margin

There is another term that I would like to explain at this place. We call it Margin. So, what is that Margin? You could say that is the percentage of your earnings in relationship to your revenue. In our scenario here, we would calculate our profit of 983 and divide that through our Total Revenue of 7,200. This equals 0.137 if you round it up. In order to get a percentage, we have to multiply this with 100, so our profit margin is 13.7%. That is already very good. As a rule of thumb: The higher our profit margin, the more lucrative is our business. And maybe we should keep this our little secret at the moment because once many people know how lucrative our little business is and can get, we might have hundreds of people competing against us and we would have to find a way to stay on top of that competition. So pssst 😉

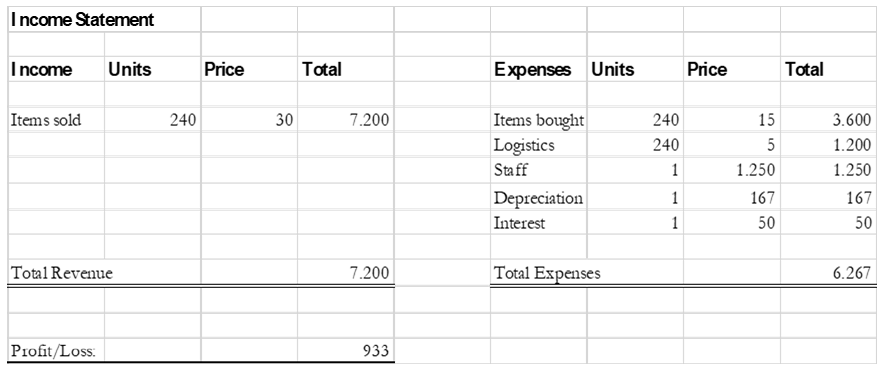

Interest

But wait, didn't we forget anything here? Oh yes, we were borrowing some money when we started our business and we have to pay some interest for that. As you know by now, one of the main drivers of the value of money is inflation, the loss of value of money over time. This is why every investor wants to have some return for their investments and ideally, that should be above the inflation rate. We agreed on a loan of 500 with a 10% interest rate, therefore we have to pay 50 in interest.

After payment of the interest our profit goes down to 933 in total. Still pretty good given that we are not actually involved in the business. Plus, we already created a job. So now our goal should be to grow and nourish the business so our employees and we as owners can have a life in abundance by delivering value to our customers.

Since all our numbers are pre-taxes, we need to be careful as the amount we see in our income statement is not yet our actual earnings after everything is paid. We will talk about taxes in a later chapter, for now we should have a look on how we invest further.

Make sure to check out my next blogpost! It will be about investments as well as equity vs. debts regarding an amazon drop shipping business.