BUILDING A BUSINESS TOGETHER

Let's assume for a while that I am your neighbour and you want to found a new business. And in this modern time, you want to have the maximum results with the least amount of risk. So, we choose something for our first business that is quick to set up and easy to adapt and change. Something that can be done online from all over the world. We are entering the arena of a drop shipment business together.

Amazon drop shipping business

For those of you that haven't heard of it yet a short explanation. By drop shipping we are opening an online shop and are reselling goods to people interested in what we have to offer. As we don't produce ourselves and we also source out our logistics (have a look at Fulfillment by Amazon (FBA) to get a better understanding of what I am referring too). It all comes down to marketing, presenting our products and targeting the right buyers online.

I really don't care what product we are going to sell, all I would suggest is, that you find something you are passionate about so you can stand out of the crowd. Everything else will fall into place with a little bit of persistence and determination. Now let's get to the business essentials. Our business 101 so to speak so we know how to assess, develop and lead a business. It's the same for every business by the way, big or small, regional or global, producing or service only. They all work the same. Sure, they all have their specifics and no two businesses are the same, however they all work by the same rules that make businesses successful. Let's get an understanding of it now.

Create a legal entity

Now in order to form a business you have to create a legal entity and actually form that business. You do so by filling out the appropriate papers and registering the business under your name. The paperwork isn't everything as you will need some funding and some money to get the business started. Let's assume that we want to get the money in and are happy to share future profits for someone who gives us money.

We will then found the company let's say with 2,000 shares (just as an example, that could be any number). What happens next is basically that you sell a part of your business. As you have 2,000 shares it's safe to say that you can give away 500 of these shares to an investor (let's say me for example) and I will give you 500 in cash for that to start off your business. All you have done so far is to come up with the idea and the plan and convince me that your business idea is good and will be thriving in the future.

The ownership structure

now looks as follows:

- 1,500 shares YOU (75% of the company)

- 500 Shares ME (25% of the company)

- Total value: 2,000

Of course, we have big plans for the business and we want it to thrive. Therefore you quickly realize, that you will need more capital in order to get some inventory that you then can sell off quickly. While you already order more to bridge the time the goods need from the factory to the logistic center where it gets shipped to the customer for us. In order to do so we get a loan from a friend who gives us another 500 to get our business started. As it is a loan, we are obliged to give our friend some interest and in our little showcase we say it's 10% just to keep things easy to calculate later on.

Why do we rather borrow money than simply selling more stocks?

Well the upside is that we keep more of the company for ourselves and therefore we also will keep more of the future profits. The downside on the other hand is, that we will have to pay interest for the money we borrowed. That means that it is only a good deal for us, when the return we get from the money exceeds the interest we have to pay. In our case: If we get more than 10% in return we are making a profit compared to selling more stocks. As we are highly convinced that we can do so, we go for the loan.

Balance sheet

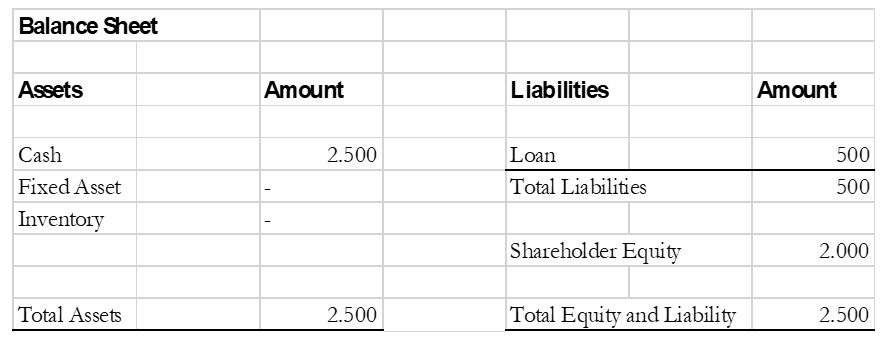

Now let's start to get a little bit more technical and have a look at our initial balance sheet. We came up with 2,000 shares valued at 1 each. 500 were sold for cash plus we got another 500 in cash as a loan. In the simplest form a balance sheet consists of two parts. On the left side we have what we call assets. In our case that is only cash in the bank so far since we don't have any inventories, machines etc. yet. The left side (Assets) shows you where your money is invested at. Our total here is 2,500 in assets sitting in our bank account.

The right side of the balance sheet tells you where the money comes from. And there are only two general types of sources. It can be the companies own money (that would be named Equity) or it can be someone else's money, that that case it would be called a liability or debt. This is how our current balance sheet would look like now:

Please note that the left and the right side ALWAYS need to show the same amount as you can't have money without a source and you certainly can't have invested money into something that doesn't belong to anyone. So, the total assets always equal the total liabilities + equity.

Let's start our business operations

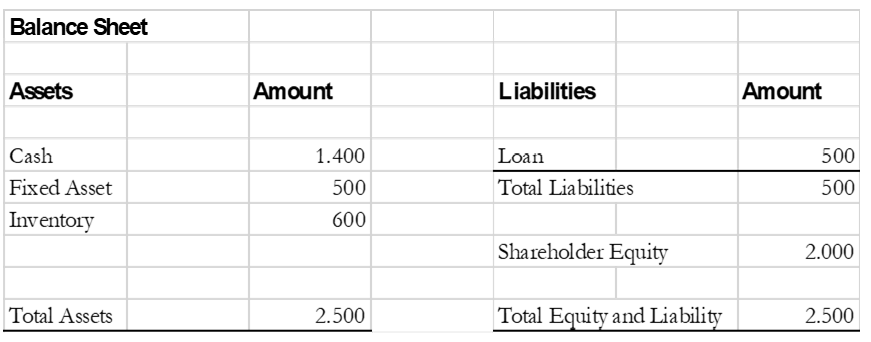

As already mentioned we will need some inventory, this is where we buy something upfront in order to sell it. In a drop shipping business, we ideally want to have nearly no inventory and always deliver from the factory to our customer. That of course doesn't work when we have weeks of delivery times, hence we calculate some stock to bridge the gap so while we sell off our inventory the new products have time to arrive. After all we want to have highly content customers. We did a good research on our customers wants and needs and how we can deliver great products, so we are confident that we can sell our initial stock of 600 off.

We also need to track our orders, answer customers emails, post our products, get pictures and so on. So we decide to buy a tablet to work with and be able to easily interact with our suppliers, customers and partners. As we don't intend to sell the tablet, it doesn't belong in our inventory but rather into a category called fixed assets. These are things that we keep for a longer time to work with it, like our tablet. We spend 500 on that and we are good to start.

Here is how our balance sheet changed:

As stated before, the total amount of assets and liabilities/equity is still the same. Since no new money got into the company all that happened is that the money went from our cash balance into our tablet (fixed asset) and our inventory for faster delivery.

So far so good! In my next blogpost, you will find out more about the Income Statement, Earnings, Interest and Investments as well as Dividends. 🙂