BUILDING A BUSINESS TOGETHER – PART 3

Investments

Let's have a look at the future of our business and how we can grow that. The first decision would be if we take the money out of the company or use it for further growth. Since we are only at the beginning and want to grow the business substantially, we as shareholders decide together to leave the money in the business and foster the growth of the company. Here is an outlook how that could look like.

More Cash on stock

First of all, we will need some more cash on stock and we also decide to get involved into a second product which then generates more business. We also want to build our brand and do some advertising on social media to attract more customers and turnover. All these initiatives cost us money, so it's good that we are already earning money and don't need any further outside investors at the moment.

As we build our brand with our advertising activity and great customer reviews, we can begin to charge a little bit more than we did in the past. Just a little bit of course as we want to be highly competitive and don't shy away customers by appearing too expensive.

For our growth calculation

we assume that we can sell 10% more each year and that we are able to charge 5% more due to brand building and the great reviews. Let's have a look at our second year.

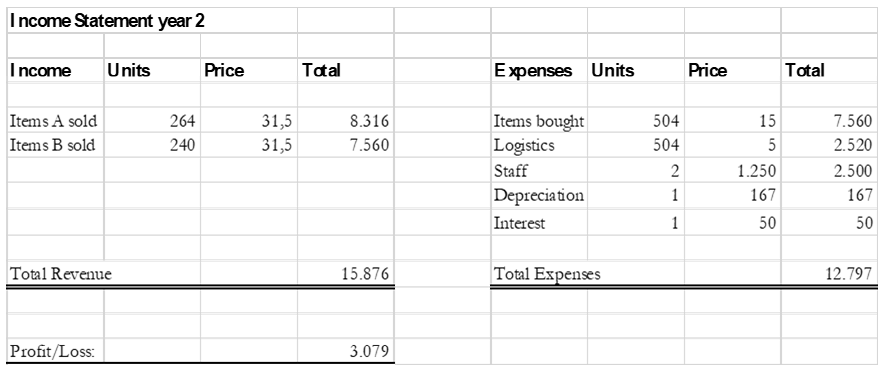

We can see the new product line, the increased sales prices and the growth on the left side of our income statement. On the right side we now need to purchase 504 items (both products combined) and also pay shipping for 504 items.

And of course, we will need more labor, therefore we doubled our workforce. After paying interest we end up with a pre-tax earning of 3,079. We pretty much tripled our results within a year. What a great result. Now let's do the same thing again and see how year three would look like.

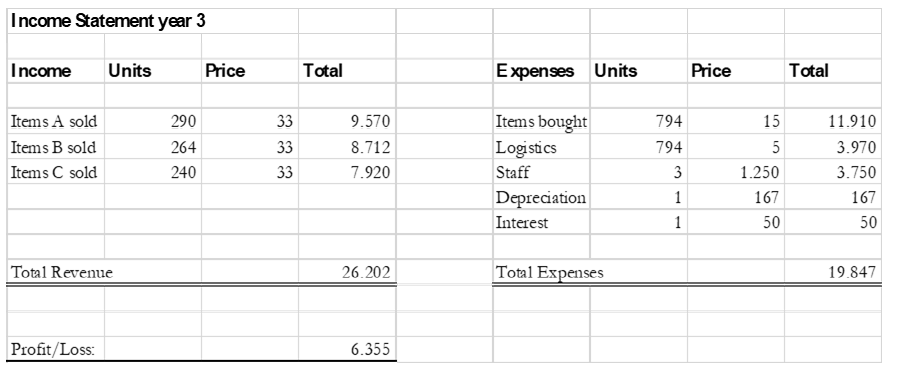

Sell different products

As you can see we now sell three different products, we have further 10% growth for each of our past products and we were able to raise prices again. On the right side we buy 794 items and pay logistics for the same amount of items being shipped for us. We will need more work force as well, so we hired another person to work for us. Our pre-tax profit now went up to 6,355. Not bad although we didn't triple again. Only a bit more than doubling. Obviously our profit growth slows down a bit.

Margin

To determine how well our business is doing we have a look at our margin again. Remember that was our profit divided by our revenue. In our year three prediction this would be 6,355 / 26,202 which would equal 0,243. Multiplying it by 100 we get a margin of 24.3%. As we started out with 13.7% that got significantly better. Therefore we can be very happy with our business right now.

Since we have more and more money we now could either decide to invest more or actually getting some of that money to the shareholders. Before we do so let's have a look at the shareholder concept.

The Shareholder Concept

The very reason why we went into business together is because we needed to raise some capital to start the business. That's why parts of the business were sold to people who were willing to take the risk and invest into our idea. As a shareholder the risk for them is a total loss. When our idea wouldn't have worked out, all of the money would have been gone.

On the other side having a successful business can be extremely rewarding since the income in year three is predicted to be 6,355 and we already earn way more than the 2,500 that have been raised at the beginning. So by now we could get even more money each year out of that investment than we ever put in. That is extremely rewarding. Every company needs money in order to start implementing their ideas or to develop new products.

Depending on the nature of the company that can be as little money as we used in our example or actually billions to develop a single product like a new car model. That is currently estimated as much as $6 billion. Or in numbers: 6,000,000,000. Which is a whole lot as you can imagine.

Equity vs. Debt

Shareholders vs Creditors

There is a huge difference though between shareholders that get what we call equity (a stake in the company) and creditors that loan us money. We already know that shareholders face the risk of a total loss of their capital if the business they invested in should fail. That is not pleasant and high risk usually comes with potentially high rewards. Why would I have given you 500 that could have been gone in the first year if the return wouldn't be good?

Loan from a creditor

On the other side we have the loan, where we got into debt and borrowed 500 from a creditor. When a company struggles and fails, the creditors are the first ones to get paid of what is left in the company. So they have a higher security. Plus, they get a regular payment of the interest, so they get money every year. If the business doesn't do very well they still get paid. The shareholders on the other side might not get paid at all if the business has a bad year.

All the creditor get is the payment of the interest. In our scenario 5% or 50 based on the 500 loan. Me as a shareholder with the same 500 investment could get up to 25% of the earnings that are getting paid out. imagine we would pay out only 3,000 of our 6,355 earnings in year three.

In that scenario my 25% stake would give me a return of 750 compared to the 50 the creditor gets. Being an equity owner means higher risk and in case of success can be a much higher reward as well. The secret to success in being a company owner (and as traders and investors this is what we do) lies in selecting great and successful companies.

We will talk more about that later on in another chapter.

Dividends

Let's close this chapter with the payment of dividends. A dividend is what you get as a shareholder when the company pays out their earnings. Of course, everything has to be paid beforehand, also the taxes that we didn't talk about here yet.

But whatever is left in the business after everything is paid, can be paid out to the shareholders. Since companies are focused on growth, they typically don't pay out all of their earnings as they keep investing in the business. The typical payout ratio nowadays is that around 30-40% of the earnings are paid out as a dividend to shareholders. It always depends of course how much money is needed and retained for future growth.

Growth is everything

As we have seen by now, growth is everything for a company. The growth that we have year over year determines how much we will get in the future and usually it's the best investment that can be done. Especially since there won't have to paid any taxes on these investments.

That's one of the reasons why successful companies always have the best tools and newest things to make their life easier and more successful. And that is a great thing as it stimulates growth with other companies. All that a company buys has to be produced by another company. This is one of the reasons for technological progress and our source of wealth. Worldwide.

And it's the most fascinating thing for me to be a part of it (and I hope for you it will be soon too).

🙂